By Federico Giuliani

Pakistan’s economy has not shown any signs of improvement in the last couple of years. All the PTI government led by Imran Khan has managed to do is to appoint new finance ministers, who feebly attempt to revive the economy.

Unfortunately for them, current economic indices are by themselves so poor making the task of revival doubly difficult.

Fiscal mismanagement combined with a lack of interest in setting right the fundamental flaws in Pakistan’s financial situation has created conditions of a downslide that may soon become irreversible.

Against this background, comes news of Foreign Direct Investment (FDI) into Pakistan sliding by 12 per cent in the first four months (July to October) of the current fiscal year.

Shaukat Tarin, appointed as the Minister of Finance by Prime Minister Imran Khan in April this year had targeted a growth rate of between 4 to 5 percent.

An objective worth attempting, but the contractionary monetary and fiscal policies supported by his predecessors make it extremely difficult to even begin to re-start the economy.

Since May 2019, when Pakistan signed a staff-level agreement with the IMF, their subsequent suspension due to Covid-19, and the February 2021 second to fifth review which envisaged their re-execution, all make it clear that claims of economic stabilisation had been achieved by Pakistan in the last calendar year do not reflect ground realities.

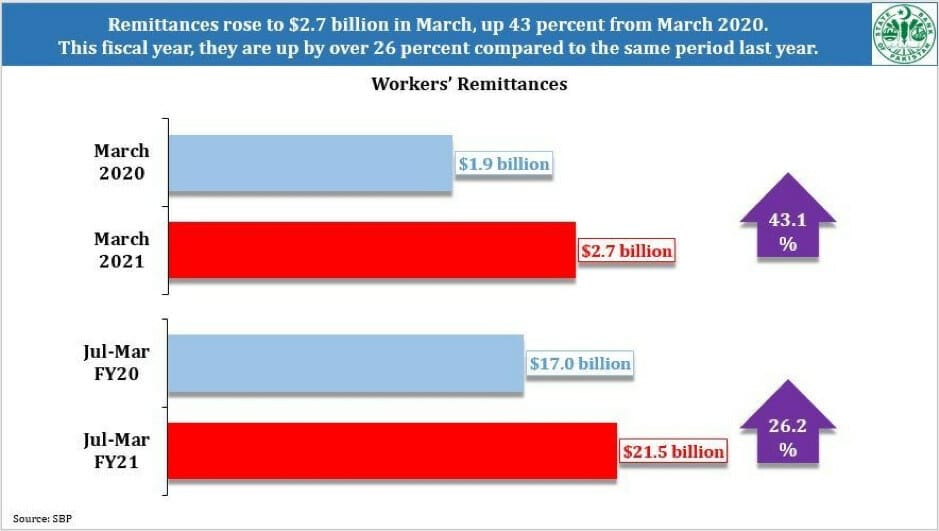

The data made available by the State Bank of Pakistan (SBP) is one such indicator. In real terms, FDI inflows stood at US$662 million during the four-month period compared to US$750million a year ago.

In October 2021, inflows plunged by 24per cent to US$223million from US$293million in the same month, a year ago. Pertinently, Pakistan has been unable to attract significant FDI investment for than five years now.

This comes at a time when the Pakistan government desperately needs foreign inflows and is negotiating with the International Monetary Fund (IMF) for the resumption of financial aid.

There is therefore an urgent need for the Pakistani government to engage in policies that focus not on higher outlay or expenditure, but on reducing its own expenditure which one hopes would ease pressure to borrow.

The real fault line in the economy of Pakistan lies in continuing to borrow to fund the annual rise in government expenditure.